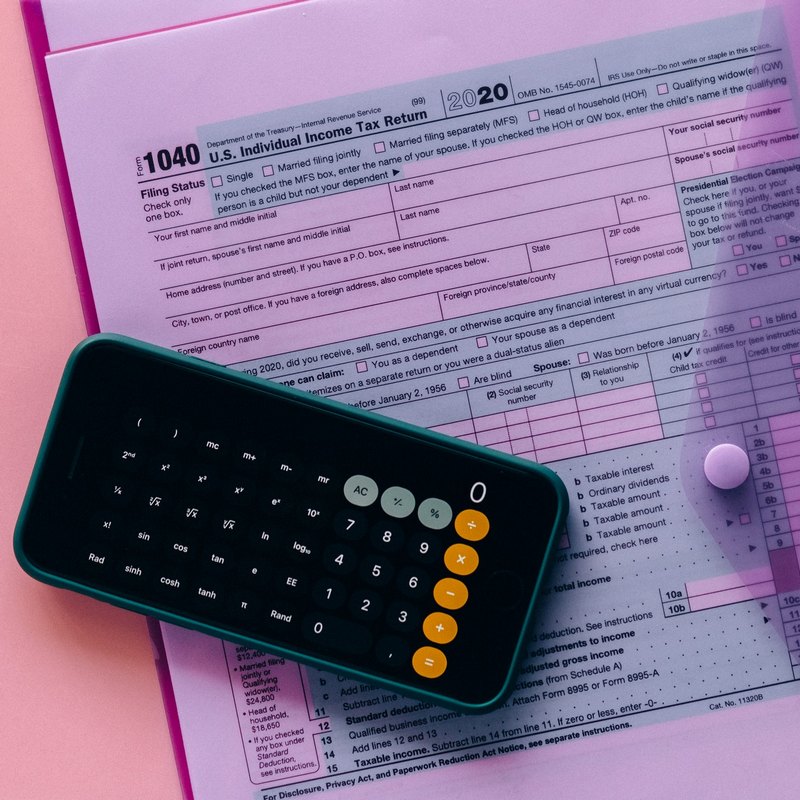

Property Taxes in the United States

2021-01-05 | taxes | No Comments

Property taxes do not exist at the federal level, but are levied at the state, county, city, or even district level. That said, property taxes can vary greatly.

For example, it may be normal for neighboring houses of approximately equal square footage belonging to different neighborhoods to be taxed at different rates. The reason may be that in one area, the main tax burden may be shifted to a large business, while in another area, the tax burden may be shifted to the residents of the neighborhood.

The size of the tax rate can also be affected by the value of the home. It is not necessarily the case that neighborhoods with more expensive housing will pay more taxes. The situation can often be the opposite.

And there is the fact that property tax rates can vary not only between states but also within a state. Here’s another example: Georgia has relatively low property taxes. The average fee in the middle of the state is $560, but in the Atlanta suburbs it jumps to $2760.